Have you ever heard someone talk about a “Chief Revenue Officer” at a company and wondered what it really means? Don’t worry—you’re not alone. A Chief Revenue Officer (CRO) might sound like a fancy title, but their job is one of the most important roles in any growing business. In this easy guide, we’ll explain everything about what a CRO does, why this role matters so much, and how you can even become one. Whether you’re just curious or you’re thinking about a career in leadership, you’ll find answers here in plain English.

What Does a Chief Revenue Officer Do?

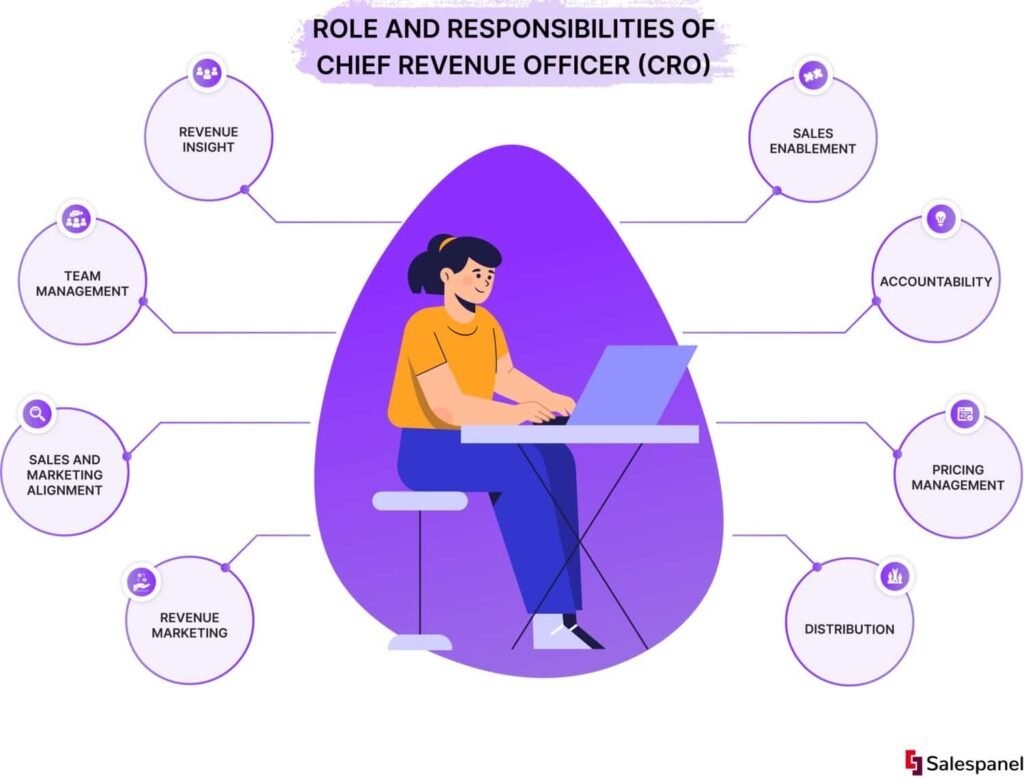

A Chief Revenue Officer (CRO) is the person in charge of all the ways a company makes money. Unlike other executives who focus on one area, like sales or marketing, a CRO looks at the whole picture. They make sure that sales, marketing, customer service, and even product teams work together smoothly to bring in as much revenue as possible.

Think of the CRO as the captain of a ship where every crew member has a different job. Some are rowing, some are fixing sails, and some are navigating. The CRO makes sure they’re all moving in the same direction. Their day-to-day work involves setting goals for revenue, designing strategies to grow income, and spotting problems that could slow down growth. They also monitor data and trends to adjust plans quickly when needed.

For example, if a software company isn’t meeting its subscription targets, the CRO might analyze the sales funnel, find where potential customers drop off, and work with both marketing and sales teams to fix it. This makes the role incredibly dynamic because they’re involved in almost every department’s success.

Why Is a Chief Revenue Officer Important?

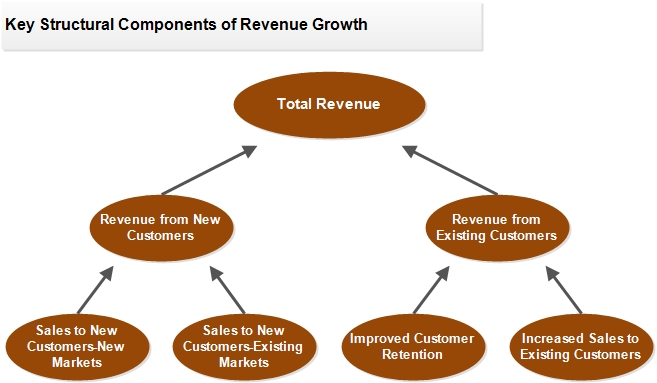

Businesses today are more complex than ever. There are more products, more competitors, and more ways customers interact with companies. If sales and marketing teams don’t work hand in hand, opportunities for revenue can easily slip away. That’s where a CRO becomes essential.

The CRO bridges gaps between departments that traditionally work in silos. By aligning sales, marketing, and customer experience strategies, they help companies grow faster and more efficiently. For startups and growing businesses, a strong CRO can mean the difference between staying small and becoming an industry leader.

Moreover, in industries like SaaS (Software as a Service) or e-commerce where customer retention is critical, the CRO ensures long-term growth rather than quick wins. They’re not just about hitting this quarter’s numbers—they’re about building sustainable revenue models.

Key Skills Every Chief Revenue Officer Needs

To succeed as a CRO, a person needs a unique mix of skills. This isn’t a job for someone who’s only good at one thing. The best CROs are part leader, part strategist, and part data scientist. Let’s break it down:

Leadership Skills

A CRO has to inspire teams across departments. They need strong leadership abilities to align different groups toward shared revenue goals. This means excellent communication, decision-making, and the ability to resolve conflicts between teams. Great CROs can build trust quickly and motivate people even in tough times.

Sales and Marketing Knowledge

Since revenue depends heavily on sales and marketing, a CRO must understand both fields deeply. They should know how to design sales processes, analyze customer behavior, and develop marketing campaigns that attract and retain customers. This dual expertise allows them to connect dots others might miss.

Data and Analytics Understanding

In today’s business world, decisions are made based on data—not guesses. A CRO must know how to read analytics reports, understand KPIs (Key Performance Indicators), and use data to predict trends. They need to spot patterns and pivot strategies when the numbers don’t look good. This analytical mindset helps them guide the company toward smart, data-driven growth.

How to Become a Chief Revenue Officer

Becoming a CRO doesn’t happen overnight. Most people in this role start in sales, marketing, or finance and work their way up. Here’s a general path:

Start by gaining strong experience in sales or marketing. Learn how to manage teams, grow accounts, and drive customer success. Over time, move into leadership roles like VP of Sales or VP of Marketing. From there, develop cross-departmental knowledge by collaborating with other teams.

An MBA or similar advanced degree can also help, but it isn’t always required. What matters more is proven success in driving revenue growth and aligning multiple departments. Building a reputation as someone who can deliver results consistently is key to reaching the CRO level.

Networking with executives, learning from mentors, and staying on top of industry trends will also give you a competitive edge.

Chief Revenue Officer vs Chief Financial Officer

People often confuse the CRO and CFO roles because both deal with money. But there’s a big difference.

The Chief Revenue Officer focuses on how the company makes money—through sales, marketing, partnerships, and customer retention. They are outward-looking and growth-focused.

The Chief Financial Officer (CFO), on the other hand, manages how the company spends and manages money. They handle budgets, expenses, investments, and ensure financial stability. In simple terms, the CRO brings money in, and the CFO manages what happens to that money.

Both roles are critical, and in many successful companies, they work closely together to keep revenue growing and finances healthy.

Average Salary of a Chief Revenue Officer in the USA

One of the most attractive parts of becoming a CRO is the salary. This is one of the highest-paid roles in any company because it directly impacts business success.

Entry-Level CRO Salary

In the United States, an entry-level Chief Revenue Officer (with around 5–7 years in senior management) can expect to earn between $150,000 and $220,000 per year, depending on the company size and industry.

Experienced CRO Salary

For seasoned CROs with 10+ years of leadership experience, salaries typically range from $250,000 to over $400,000 annually. Many also receive performance bonuses, stock options, and other perks that can significantly increase total compensation.

Tips for Becoming a Successful Chief Revenue Officer

- Build cross-functional expertise – Understand not just sales but marketing, finance, and customer success.

- Stay data-driven – Use analytics to guide every decision.

- Develop strong leadership habits – Learn how to align large teams and inspire them toward common goals.

- Network with other executives – Build relationships that can open doors to CRO roles.

- Keep learning – Stay updated on market trends and innovations in revenue strategies.

Thoughts on Chief Revenue Officers

The Chief Revenue Officer is more than just a trendy title—it’s a critical role that ensures a company’s growth engine runs smoothly. With businesses facing global competition and fast-changing markets, a CRO acts as the glue that holds revenue strategies together.

For aspiring leaders, aiming for this role can be both challenging and rewarding. It requires not just technical know-how but also vision, resilience, and the ability to lead teams through change.

The Bottom Line

The Chief Revenue Officer is one of the most dynamic and impactful roles in modern business. They’re responsible for aligning sales, marketing, and customer success efforts to maximize revenue and keep companies growing. If you’re aiming for this role, focus on building broad skills, gaining leadership experience, and staying obsessed with driving results. For businesses, investing in a strong CRO could be the smartest decision they ever make.